Main Menu

Enjoy maximum FDIC coverage for all of your deposits – up to $50 million – with ICS.

Home » IntraFi Cash Service (ICS)

Peace of mind. Rest assured knowing that funds are eligible for FDIC insurance protection in amounts well into the millions, all backed by the full faith and credit of the federal government. And since deposit accounts are not subject to floating net asset values, you can feel secure knowing that market volatility will not negatively affect principal.

Interest. Put cash balances to work in demand deposit accounts and money market deposit accounts.

Liquidity. Enjoy access to funds placed through ICS into demand deposit accounts and money market deposit accounts.

Time savings. Work directly with just us―a bank you know and trust―to access multi-million-dollar FDIC insurance and forego the need to track collateral on an ongoing basis, or to manually consolidate statements and disbursements from multiple banks.

Community support. Feel good knowing that the full amount of funds placed through ICS can stay local to support lending opportunities that build a stronger community

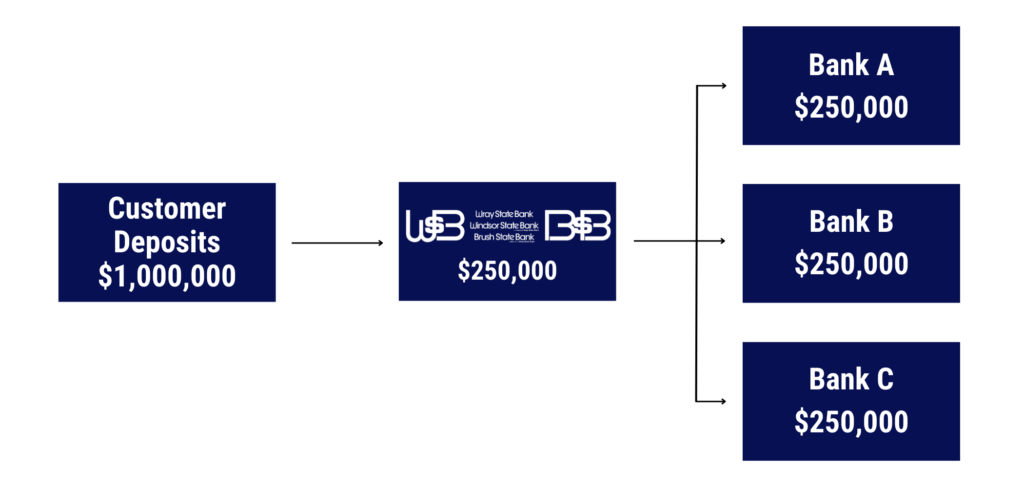

Wray State Bank and its branches, like other institutions that offer ICS, are members of the IntraFi network. When we place your deposit through ICS, that deposit is divided into amounts under the standard FDIC insurance maximum of $250,000. The amounts are then placed into deposit accounts at multiple FDIC-insured banks. As a result, you can access FDIC coverage from many institutions while working directly with us.

Receive one statement, summarizing your ICS deposit, from WSB and access key details about your accounts online, 24/7.

And, as always, know that your confidential information is protected.

Would you like to access multi-million-dollar FDIC protection on your deposits, earn interest, and enjoy flexibility at the same time? Now you can—through ICS®, the IntraFi® Cash Service.

With ICS, you can:

Rest assured. Make even large deposits eligible for protection that’s backed by the full faith and credit of the federal government.

Earn interest. Put excess cash balances to work by placing funds into demand deposit accounts, money market deposit accounts, or both.

Save time. Work directly with just our bank—a bank you know and trust. Receive just one monthly statement from us summarizing your account activity and balances. And, if you are accustomed to collateralization, reduce the need to track collateral on an ongoing basis.

Access funds. Enjoy unlimited withdrawals of funds placed in demand deposit accounts, or make up to six program withdrawals per month of funds placed into money market deposit accounts. Your funds can be placed using either or both ICS options to best match your cash management and liquidity needs.

The FDIC insures up to $250,000 per depositor for each account ownership category in a given insurable capacity at an FDIC-insured depository institution. When your funds are placed through ICS, they are divided into amounts under the standard FDIC maximum and placed with other institutions participating in IntraFi’s network—each an FDIC-insured institution. This makes your deposit eligible for FDIC insurance at each member bank. By working directly with our bank, you can access insurance through many. You do not pay a fee to use this service, and you receive one monthly statement summarizing your ICS deposit. (You can also see, online, where your funds are at all times.)

You can make up to six program withdrawals per month of funds placed into demand deposit accounts and money market deposit accounts.

Funds placed through ICS are deposited only in FDIC-insured institutions. We act as custodian for your ICS deposits, and BNY Mellon acts as subcustodian for the deposits.

Through ICS, funds are placed with other institutions participating in IntraFi’s network, and those Network members provide you with access to FDIC insurance coverage on deposits at those banks. Working directly with just our bank, you can access coverage through many.

You work directly with just us—the bank you know and trust. As always, your confidential information remains protected.

When we place your deposit through CDARS®, that deposit is divided into amounts under the standard FDIC insurance maximum of $250,000. The funds are then placed into deposit accounts at other network banks. As a result, you can access FDIC coverage from many institutions while working directly with just ours. Receive one statement from our bank detailing all your CDARS placements.

Ready to get started? Find a branch near you

If you’re looking for a bank who knows your first name, then you’re in the right place. Our dedicated and friendly staff is ready to discuss your personal banking needs.

Copyright © 2023 Wray State Bank. All Rights Reserved. | Disclosures | Privacy policy | Security | Accessibility Statement | Site by SageMG.